Table of Contents

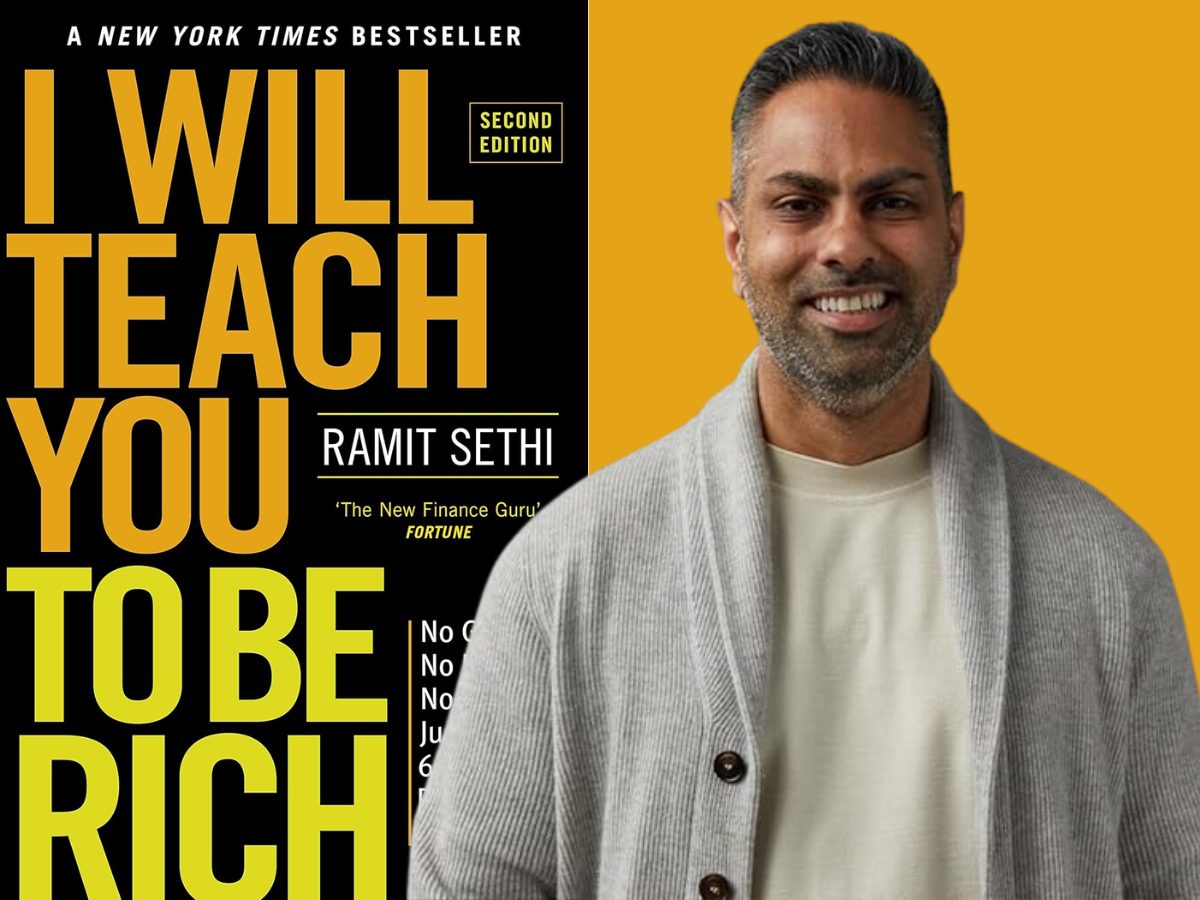

1. I Will Teach You to Be Rich by Ramit Sethi

In I Will Teach You to Be Rich, Ramit Sethi presents a direct, actionable, and psychology-driven guide to building personal wealth. Originally published in 2009 and revised a decade later, the book targets young professionals and entrepreneurs looking to optimize their personal finances through proven systems, automation, and mindset shifts. Unlike conventional personal finance guides focused on penny-pinching, Sethi encourages readers to “spend extravagantly on the things you love and cut mercilessly on the things you don’t.”

For audiences interested in leadership, entrepreneurship, or self-improvement, this book is highly relevant. It doesn’t just cover technical steps like investment strategies and credit card optimization—it also challenges readers’ psychological barriers and cultural money scripts. These lessons are invaluable for anyone managing a team, running a business, or trying to build a high-performance lifestyle around clarity, autonomy, and financial strength.

Main Premise and Key Themes

Sethi’s main premise is that most people can build lasting wealth by following a set of smart but simple decisions over time. Rather than overloading on information, readers are guided through a 6-week program that covers everything from choosing the right bank accounts and investment portfolios to managing spending without guilt.

He focuses on:

- Automation over discipline: Create systems that work in the background so you don’t have to rely on willpower.

- Big wins over small savings: Stop obsessing over $3 lattes and focus on the decisions that save you thousands.

- Behavior over budgeting: Use psychology and invisible scripts to change your money mindset and spending habits.

- Defining your own “Rich Life”: Align your money with your personal values and goals rather than arbitrary benchmarks.

Summary of Main Ideas and Arguments

1. Psychology and Personal Responsibility

Sethi argues that many people are paralyzed by guilt, shame, or complexity around money. He encourages readers to reject a victim mindset, understand their emotional scripts around money, and adopt a mindset of ownership.

2. A Practical 6-Week Financial Program

The book outlines a six-week action plan that starts with optimizing credit cards and bank accounts, moves into investment and conscious spending, and finishes with automation and building wealth.

3. Conscious Spending Plan

Rather than traditional budgeting, Sethi promotes a four-bucket system: fixed costs, investments, savings, and guilt-free spending. This empowers readers to spend lavishly—without guilt—on the things they love.

4. Investment Made Easy

Sethi demystifies investing by emphasizing low-cost index funds, target-date funds, and simple asset allocation. He makes it accessible even for those starting with as little as $50.

5. Automation is King

Readers are shown how to set up automatic transfers between accounts to manage bills, savings, and investments. This approach reduces decision fatigue and ensures consistent financial progress.

6. Advanced Topics for Entrepreneurs and High Performers

Chapters later in the book address salary negotiation, buying real estate, and creating ten-year wealth-building plans—ideal for leaders and entrepreneurs looking to maximize their financial footprint.

Practical Lessons for Leaders and Entrepreneurs

1. Define Your “Rich Life”

Clarity drives decision-making. Know what “rich” means to you—freedom, experiences, time, impact—and use that to filter financial choices.

2. Automate Everything

Leaders must minimize distraction. Automating money flows lets you focus on strategic work without worrying about budgeting minutiae.

3. Focus on Big Wins

Ignore $3 coffee debates. Instead, negotiate a $10,000 raise, cut bank fees, invest in index funds, or build revenue streams—these yield massive results.

4. Build Systems, Not Habits

Systems—like auto-savings, fixed spending ratios, or investment schedules—scale better than willpower and are ideal for busy professionals.

5. Embrace Imperfection

Getting started is more important than being perfect. Implement the “85% Solution”: act now, refine later.

6. Think Long-Term

Wealth is built over decades. Start early, stay consistent, and avoid market timing or short-term panic.

2. Would You Rather Be Sexy or Rich?

Ramit Sethi begins I Will Teach You to Be Rich (Second Edition) with a powerful and unconventional question: Would you rather be sexy or rich? This provocative opening sets the tone for a book that refuses to follow traditional advice. Rather than talking down to readers or pushing guilt-based strategies, Sethi uses personal stories, humor, and psychology to break down why people struggle with money and how they can take control—without deprivation or perfection.

At the heart of the introduction is a compelling parallel between personal finance and fitness. Just as most people don’t gain weight overnight, financial problems also accumulate gradually. Sethi points out that we often fail financially not because we lack intelligence but because we are overwhelmed by too much advice and too many options. In both dieting and money management, people love to debate minutiae rather than take action. For example, we might obsess over Whole30 vs. paleo diets or over the interest rates on different savings accounts, while ignoring the basic principles that actually lead to results.

1. Why Money and Food Are So Similar

Sethi compares the psychology of eating to the psychology of money. People don’t track calorie intake, and they don’t track spending. They eat more than they realize and spend more than they admit. Most importantly, they focus on minor details and fads instead of sticking to proven basics.

He illustrates this comparison with a table showing parallels: when it comes to food, we overeat and argue about diets; when it comes to money, we overspend and debate about stocks or credit cards. Instead of focusing on foundational habits—like automating savings or eating balanced meals—we chase trendy advice and fail to build systems.

2. Why Managing Money Is So Hard

Sethi acknowledges that managing money is difficult, not just because of financial illiteracy, but because of psychological resistance. People either ignore money entirely or obsess over it, achieving nothing in either case. He explains that most people don’t need a financial adviser. What they need is a system that handles their finances automatically, consistently, and without requiring daily input.

A major barrier is information overload. Sethi refers to Barry Schwartz’s research in The Paradox of Choice, which shows that too many options lead to decision paralysis. For instance, when employees are given more mutual fund options in their 401(k) plan, participation actually decreases. The same applies to managing personal finance—too many options, and we end up doing nothing.

He provides a compelling chart comparing “Smart Sally” and “Dumb Dan” to illustrate the power of starting early. Sally invests $200 a month from age 35 to 45 and stops, while Dan starts at 45 and continues until 65. Despite investing for half as long, Sally ends up with about $60,000 more. This example shows that starting early is more impactful than trying to do everything perfectly later.

3. The Danger of Victim Culture

One of the most controversial but honest parts of the introduction is Sethi’s rejection of victim culture. He critiques those who blame politicians, economic policy, or baby boomers for their financial situations while refusing to take personal responsibility. He shares an example from his “Save $1,000 in 30 Days Challenge,” where some participants thrived, but others reacted with outrage, claiming they didn’t earn enough to save anything.

Sethi’s response is blunt: cynics don’t want results—they want excuses. By refusing to accept personal agency, they remain stuck. He illustrates this mindset with examples like, “LOL! Invest? I can’t even save for pizza.” Such thinking may feel comforting in the short term, but it leads to long-term financial failure.

4. The Solution: Start with Small Steps

To counter these patterns of avoidance and overwhelm, Sethi introduces what he calls the 85 Percent Solution: getting started is more important than getting it perfect. You don’t need to be an expert or wait until everything is perfectly aligned. Taking small, consistent actions leads to long-term gains.

He uses the metaphor of cooking a grilled cheese sandwich. You don’t have to be an Iron Chef to cook something simple, and once you do, you build the confidence to tackle more complex recipes. The same is true for money—you just need to begin.

Sethi urges readers to stop living in the spreadsheet. He warns against obsessing over financial details or constantly tweaking budgets and investments. Instead, set up automated systems, align your spending with your values, and move on with your life.

5. Define Your Rich Life

The final part of the introduction shifts focus to purpose. Why do you want to be rich? Sethi asks readers to define what a “Rich Life” actually means to them. It could mean traveling internationally, funding a school, or simply helping your parents retire. The point is that wealth is not just about numbers—it’s about using money as a tool to live a life of freedom and intention.

Sethi offers examples from his own life and those of his friends. One friend spends lavishly on fine dining, another on travel, and another on clothes. These examples show that being rich doesn’t look the same for everyone—and that’s the point. Readers are encouraged to clarify their personal vision of a Rich Life so they can make financial decisions in alignment with what truly matters to them.

Get Started Today

Sethi ends the introduction with a clear call to action: put aside excuses and start building your Rich Life now. Whether you’re saving $50 or $500, investing early or late, you can take control of your finances. The goal isn’t to be perfect or to follow a complex set of rules. The goal is to take small, consistent actions that add up to something extraordinary.

The introduction is more than a preface—it’s a manifesto. It challenges your assumptions, confronts your excuses, and equips you with a mindset that prioritizes progress over perfection. For anyone ready to get serious about money without guilt or overwhelm, this is where the journey begins.

3. Optimize Your Credit Cards

In Chapter 1 of I Will Teach You to Be Rich, Ramit Sethi begins his six-week program by tackling one of the most misunderstood and misused tools in personal finance: credit cards. Rather than fearing them, Sethi urges readers to go on the offensive—to optimize, negotiate, and leverage credit cards to improve their financial lives. The message is simple: when used responsibly, credit cards can be a gateway to building credit, earning rewards, and managing money more effectively.

1. Understand the Power and Danger of Credit Cards

Sethi opens with a realistic perspective. Credit cards offer massive perks: they are essentially interest-free short-term loans, offer purchase protection, and can earn you thousands in cash back or rewards. However, they are also dangerous if misused. Most Americans are aware of their pitfalls—late fees, overspending, and high interest rates—but few know how to harness their power to work in their favor.

Sethi’s strategy is clear: play offense. Don’t just avoid fees—optimize your cards, squeeze every perk, and use credit to build your financial infrastructure.

2. Embrace the Art of Negotiation

Drawing from his Indian cultural background, Sethi humorously recounts how his father would spend five days negotiating the price of a car only to walk away over a $50 floor mat. This relentless approach, though extreme, is foundational to Sethi’s belief that negotiation is a skill worth mastering.

He encourages readers to call their credit card companies and ask to have annual fees waived or interest rates lowered. For instance, he provides scripts like:

“Hi. I’m going to be paying off my credit card debt more aggressively beginning next week, and I’d like a lower APR… Other cards are offering me rates at half of what you’re offering. Can you lower my rate by 50 percent, or only 40 percent?”

Sometimes these calls don’t work—but when they do, they can save hundreds or thousands of dollars over time.

3. The Six Commandments of Credit Cards

Sethi distills his advice into six core principles, including always paying your bill in full, getting fee-free cards, and never missing payments. He warns against being lured by flashy rewards if the card carries unnecessary fees or complicated terms. More importantly, he stresses that paying bills on time is the single most important thing you can do to improve your credit score, since payment history makes up 35% of your credit score.

4. Build a “Playbook” to Maximize Rewards

Sethi shares a detailed example of working with a financial planner to create a customized spending strategy based on card types. He uses the Chase Sapphire Reserve for travel and dining, a cash back card for general purchases, and an Amex Platinum for extra benefits. His travel perks are enviable: using points to fly business class and stay in 7-star resorts—for free. The result? A motto he jokingly coined: “My Body Will Only Sleep In Suites”.

The takeaway is that rewards are not just marketing gimmicks—they are tangible benefits when used intentionally.

5. Practical Action Steps for Week One

Sethi lays out a week-long set of tasks for readers to execute. These are not theoretical; they are designed to be done quickly and practically.

- Check your credit score and report. Use tools like MyFICO or AnnualCreditReport.com. Make sure there are no errors. This takes about an hour.

- Set up your credit card. Call to confirm you are using a no-fee card. If not, switch. Use Bankrate.com to find a better one if necessary.

- Automate your payments. Set up automatic monthly payments so your balance is paid off in full. If you’re in debt, automate the largest payment you can afford.

- Start paying off debt. Give yourself one week to calculate your total debt. Then, either use the snowball method (lowest balance first) or the standard method (highest APR first) to start tackling it. The key is not to overthink it—just start.

- Negotiate down your APR. Use Sethi’s phone scripts and try. It might work. If it doesn’t, nothing is lost.

- Get fees waived. Call your credit card company before your annual fee is charged. Ask for a waiver. If they say no, switch to a no-fee version of the same card.

6. The Real Cost of Bad Credit

Sethi makes it painfully clear how much bad credit can cost. For example, on a $200,000 mortgage, someone with a FICO score of 620–639 will pay $425,585 over the life of the loan, while someone with a score of 760–850 will pay just $355,420—a difference of over $70,000. That’s the cost of missing payments or not managing your credit well.

7. The Psychology of Getting Out of Debt

Sethi is a realist: getting out of debt takes time. But even while in debt, you can automate payments, track your spending, and learn to optimize your financial systems. He includes stories of people who overcame large amounts of credit card debt and still managed to start saving and investing.

For instance, one reader, Sean Stewart, paid off over $3,000 in debt using the snowball method and found it deeply motivating. Others negotiated lower rates, waived fees, and used the savings to start retirement funds and emergency accounts.

Start Now, Not Later

Chapter 1 concludes with a strong message: credit cards are not the enemy—ignorance and avoidance are. By taking simple steps—checking your score, automating payments, choosing the right cards, and negotiating—you can transform your credit cards from a liability into a powerful tool for building wealth.

The system is not about guilt or extreme frugality. It’s about control, strategy, and intentionality. And best of all, everything in this chapter can be done in just one week.

4. Beat the Banks

In Chapter 2 of I Will Teach You to Be Rich, Ramit Sethi sets his sights on one of the most overlooked money leaks in modern finance: traditional banking. His mission in this chapter is simple but powerful—get you out of bad banking relationships and into accounts that actually work for you. Sethi argues that most people stick with banks that actively harm their finances, often out of habit or a misguided sense of loyalty. This chapter is all about going on the offensive—finding high-interest, low-fee accounts and learning to negotiate like a pro.

1. Recognize That Big Banks Are Not Your Friends

Sethi opens the chapter by exposing how traditional banks operate. He describes how banks rely on consumer inaction to rake in profits—charging hidden fees, setting minimum balances, and trapping customers with complicated terms. He shares personal stories of banks charging overdraft fees triggered by their own faulty systems, including one instance where his rent check bounced because the bank seized funds from his checking account to pay off a bogus savings overdraft.

He labels these practices not just dishonest but predatory, citing how some institutions, like Wells Fargo, fraudulently opened accounts without customer consent. In his words, “There is a special place in hell for that bank teller”.

2. Understand How Banks Actually Make Money

Banks make money in two primary ways: they lend your deposits to others at high interest, and they make billions in fees. For example, overdraft fees alone earned banks over $34 billion in 2017. Sethi explains how banks allow transactions to go through even when there are insufficient funds, just so they can charge overdraft penalties, often $30 or more per transaction.

By understanding this system, you realize that your money is being used against you unless you take control of where and how it is stored.

3. Avoid the Common Psychological Traps

Sethi addresses the emotional and psychological “scripts” that keep people stuck with bad banks. Many justify staying by saying it’s too much hassle to switch or that they don’t know where else to go. Sethi mocks this logic with humor: “Do you have a lifelong love of your first thumbtack? What about your first garden hose? No? So why are we talking about how you cuddle up with your ‘first bank ever’?”

The truth is, switching banks takes a day at most, and the long-term payoff can be significant in terms of saved fees and earned interest.

4. Choose Better Banks Based on Three Criteria

Sethi lays out three critical factors to use when selecting a new bank:

Trust: He urges readers to research the bank’s history and ethics. Look for transparent fee structures and customer-friendly policies. Ask friends or browse financial forums to find which institutions are consistently recommended.

Convenience: A good bank should offer a user-friendly website, 24/7 customer service, and tools like mobile check deposit. Sethi notes that he uses a Schwab online checking account that refunds all ATM fees monthly, no matter where he is in the world.

Features: These include automatic transfers, interest-bearing accounts, and bill payment integration. If your bank isn’t helping you do these things, it’s time to find one that does.

5. Don’t Fall for the Tricks

Sethi outlines five major marketing tactics that banks use to manipulate customers:

- Teaser Rates: Short-term high interest or cash bonuses are rarely worth it.

- Minimum Balances: Requiring a $1,000 or $5,000 minimum to waive fees is a trap.

- Value-Added Services: These include “VIP customer service” that costs you more and delivers little.

- Upselling Bundled Products: Insurance, investment advice, or special accounts usually exist to benefit the bank, not the customer.

- Overwhelming Choices: By giving customers too many account types, banks encourage inertia and confusion, leading you to stick with suboptimal options.

6. Know the Types of Accounts You Need

Sethi simplifies things by focusing on two core types of accounts:

Checking Account: This is your financial inbox. All income goes here, and it becomes the source for rent, bills, savings, and investments via automated transfers. Sethi recommends a no-fee, no-minimum account and warns against traditional checking accounts that sneak in charges.

Savings Account: This is for short- to mid-term goals like vacations, gifts, and emergency funds. Sethi discourages obsessing over interest rates and instead focuses on separating this account from your checking to create psychological distance and reduce the temptation to dip into savings.

He also shares how he uses a Capital One 360 savings account and an interest-bearing Schwab checking account that work together through automated transfers.

7. Follow the Week 2 Action Plan

To implement the changes outlined in Chapter 2, Sethi gives a clear Week Two action plan:

- Open or assess your checking account. Spend an hour reviewing your account. If it has fees or minimums, call your bank and ask them to switch you to a no-fee, no-minimum version. Use assertive language and threaten to leave if necessary.

- Open an online high-interest savings account. Spend up to three hours researching and setting it up. Separate it from your checking account so you’re less likely to spend from it impulsively.

- Optionally, open an online checking account. This is for those who want to fully optimize. Online banks often offer higher interest and fewer fees, and many provide global ATM access with reimbursements.

- Consider an advanced setup. For optimization nerds, Sethi outlines how to manage multiple accounts across different banks to squeeze out extra features and returns. This might not be for everyone, but it demonstrates how flexible and powerful a modern banking system can be when designed intentionally.

Your Bank Should Serve You, Not Exploit You

Chapter 2 is a rallying cry against financial complacency. Sethi urges readers to switch from a defensive to an offensive strategy by demanding more from their financial institutions. Banks should be vehicles that support your Rich Life—not leeches that drain it.

With just a few hours of work, you can establish a system that pays more, charges less, and actually works. The outcome is more than money—it’s confidence, clarity, and the satisfaction of finally taking control.

5. Get Ready to Invest

In Chapter 3 of I Will Teach You to Be Rich, Ramit Sethi pivots from optimizing spending and banking to the most effective wealth-building strategy available: investing. With his characteristic wit and bluntness, he dispels myths about investing being reserved for the wealthy or financially savvy. Instead, he insists that anyone can—and should—start investing, even with just $50. The goal is not just to save, but to grow money over time through smart and consistent investments.

1. Understand Why Saving Alone Isn’t Enough

Sethi begins with a wake-up call: saving money, while important, won’t make you rich. Even high-interest savings accounts offer limited growth. He compares two options for a $1,000 investment: in a savings account yielding 3%, the money grows to about $2,427 over thirty years, which inflation erodes to nearly nothing. In contrast, if that same $1,000 is invested and earns 8% annually, it would grow to over $10,000—a tenfold increase.

He uses this comparison to highlight the power of compound interest, famously called “mankind’s greatest invention” by Albert Einstein. The lesson is clear: investing is the only real path to wealth for most people.

2. Face the Fear of Investing and Get Over It

Sethi explains why many young people don’t invest. Common excuses include not earning enough, not knowing how to pick stocks, or thinking investing is risky. He debunks these one by one. Most notably, he emphasizes that investing isn’t about picking stocks. It’s about using long-term, low-cost investment vehicles like Roth IRAs and 401(k)s to build consistent wealth.

He cites the staggering fact that only one-third of Americans participate in a 401(k), despite it being one of the most accessible investing tools available.

3. Start with the Ladder of Personal Finance

Sethi introduces his “Ladder of Personal Finance”—a clear sequence of steps for prioritizing your financial moves. He insists readers take each rung one at a time:

- Take the employer match on your 401(k) if available. It’s free money. For example, if your employer matches up to 5% of your $100,000 salary, that’s an instant $5,000 added to your investment account—no other deal is better.

- Pay off credit card and other high-interest debt. The average credit card APR is 14%, so eliminating this debt is a guaranteed high return.

- Open and fund a Roth IRA. If your income qualifies, you can contribute up to the annual limit. Even small amounts, like $50/month, add up over decades.

- Revisit your 401(k) and continue contributing up to the limit once your debt is under control.

- Explore HSAs (Health Savings Accounts) if you’re eligible. These accounts can double as tax-advantaged investment tools.

- If you still have extra money, consider additional taxable investments like index funds or real estate (covered more deeply in Chapter 7 and Chapter 9).

4. Choose the Right Accounts, Not the Flashiest Ones

Sethi walks readers through selecting the right investment accounts and warns against full-service brokerages that charge high fees for so-called “expert advice.” Instead, he recommends discount brokerages like Vanguard, Schwab, and Fidelity. These platforms offer low-cost index and target date funds with minimal or no account minimums.

For instance, Vanguard requires $1,000 to open a Roth IRA, while Schwab waives the minimum if you commit to $100 monthly contributions. Fidelity has no minimums at all, making it a great option for new investors.

5. Action Steps for Week Three

To get started on your investing journey, Sethi gives a clear weeklong plan:

- Open your 401(k). Spend three hours getting paperwork from HR and setting up your account. If your employer matches, contribute enough to get the full match. If not, still open the account but consider contributing elsewhere first.

- Develop a debt payoff plan. Dedicate three hours to reviewing Chapter 1’s debt strategies. Use tools like Bankrate to calculate how extra payments can save you thousands.

- Open a Roth IRA. Set it up in about one hour and begin automatic payments—even if it’s just $50 per month.

- Check HSA eligibility. If you qualify, open an account and make sure it offers solid, low-cost investment options like target date or total market funds.

6. Don’t Overthink Investment Timing—Just Start

Sethi closes the chapter by addressing the procrastination that often comes with investing. Many people worry they’re too late or don’t know where to start. His advice: don’t wait to pick the “perfect” investment. Just get started.

You don’t need to choose the exact funds now—that comes in Chapter 7. Right now, the focus is on opening accounts, funding them, and automating your contributions so that the money starts growing immediately.

The Most Important $50 You’ll Ever Invest

By the end of Chapter 3, readers have taken a major leap toward wealth building. Whether it’s $50 or $500, the simple act of investing—and doing it consistently—is what separates lifelong savers from lifelong earners. As Sethi reminds us, you don’t have to be rich to start investing, but you do have to start investing to get rich.

This chapter isn’t just a technical guide—it’s a mindset shift. It takes the mystery and intimidation out of investing and replaces it with clarity, humor, and action. The result is a confident foundation that supports the rest of your Rich Life.

6. Conscious Spending

In Chapter 4 of I Will Teach You to Be Rich, Ramit Sethi presents his signature idea of conscious spending—a strategic, guilt-free approach to managing your money without tedious budgeting. Instead of penny-pinching across every category, Sethi advocates spending lavishly on what you love and ruthlessly cutting the rest. This chapter is about building a spending system that aligns with your goals, values, and priorities.

1. Understand the Difference Between Cheap and Conscious

Sethi clarifies early on that conscious spending is not about being cheap. Cheap people chase the lowest price on everything, often at the expense of others. Conscious spenders, on the other hand, focus on value. They seek the best price where possible but are willing to spend extravagantly on things they care about. Conscious spenders also recognize trade-offs. For example, skipping a $2.50 soda at lunch to use that money for a movie is not being cheap—it’s aligning spending with personal priorities.

He illustrates this idea with the example of how his immigrant parents would clean chicken wings down to the bone—wasting nothing. That discipline reflects the essence of conscious spending: knowing what you value and refusing to waste on what you don’t.

2. Build Your Conscious Spending Plan

Rather than proposing a rigid budget, Sethi offers a flexible system divided into four major categories:

- Fixed costs (50–60%): This includes rent, utilities, groceries, and minimum debt payments.

- Investments (10%): Contributions to 401(k), Roth IRA, or other investment accounts.

- Savings (5–10%): For vacations, gifts, or unexpected expenses.

- Guilt-free spending (20–35%): For dining out, shopping, entertainment—anything you truly enjoy.

This model allows you to spend without guilt because each dollar is pre-assigned a purpose. If a friend invites you to an expensive dinner and you’ve already used your fun budget, you can say, “Sorry, it’s not in my plan this month.” It’s not personal—it’s the system doing its job.

3. Cut Costs Where It Matters

Sethi encourages you to focus on “Big Wins.” Instead of obsessing over daily coffee, target the major expenses that create the biggest drag on your finances. Rent, eating out, clothes, and travel are examples that vary widely by person. He shares how he personally zooms in on just two or three categories—like travel and clothing—that vary month to month. This 80/20 approach helps reduce mental fatigue while maximizing savings.

He also recommends using tools like Mint.com to track and analyze trends. One reader used a spreadsheet to reduce discretionary spending by 43% in eight months by simply monitoring his habits.

4. Handle Social Pressure and Lifestyle Inflation

Conscious spending isn’t just a solo act—it’s influenced by peer pressure. Sethi discusses the “Sex and the City” effect, where friends subtly push each other to spend more. He shares a story of two friends at dinner: one contemplating a new iPhone and the other pressuring her to buy it, despite no real need. Conscious spenders learn to resist this pressure and make independent decisions.

He also warns against uncritical lifestyle inflation. Just because you get a raise doesn’t mean you need a new car. He advises enjoying a portion of the raise, then banking or investing the rest. One example features Jason Henry, who saved $10,000 on a modest retail salary by banking half of every raise into his 401(k).

5. Action Steps for Week Four

To implement the conscious spending philosophy, Sethi provides a practical Week Four action plan:

- Calculate your current spending. Break your take-home pay into fixed costs, savings, investments, and guilt-free spending. Don’t overthink this—just get a baseline version working today.

- Optimize expenses. Use the À La Carte Method. Break large costs like insurance or vacations into manageable monthly chunks and find savings opportunities. Ask: can I get a better deal?

- Choose your Big Wins. Use tools like You Need a Budget or Personal Capital to identify one or two areas where you can save big—like canceling unused subscriptions or changing your cell phone plan.

- Maintain your plan. Spend an hour each week entering receipts, reviewing your system, and adjusting percentages if needed. This maintenance keeps your plan functional without becoming a chore.

6. What If You Can’t Save Yet?

Sethi acknowledges that some people genuinely live paycheck to paycheck. For them, the plan may not be immediately executable, but it can serve as a guiding framework. He encourages such readers to shift their focus from cutting expenses to earning more. He suggests negotiating a raise or starting a side hustle. After all, there’s a limit to how much you can cut, but no limit to how much you can earn.

Spend with Intention, Not Guilt

Chapter 4 is one of the most transformative sections in the book. It replaces anxiety and guilt with structure and freedom. Conscious spending is about choosing how to live your life and aligning your money accordingly. You no longer have to ask yourself, “Can I afford this?” because the plan answers it for you.

With this system, you can finally enjoy spending on the things you love without second-guessing yourself. That’s not just smart finance—it’s financial confidence.

7. Save While Sleeping

In Chapter 5 of I Will Teach You to Be Rich, Ramit Sethi introduces the concept of automating your money—a powerful method to take the stress and friction out of managing finances. The core idea is that your money should move exactly where it needs to go without requiring ongoing attention or emotional energy. Rather than playing defense by trying to cut more spending manually, Sethi proposes building a system that runs in the background and builds wealth automatically.

1. Create Your Automatic Money Flow System

Sethi compares his love of automation to how others feel about newborn babies. He proudly shares how he created systems to manage scholarships, emails, and even his plants while traveling. But none of those, he says, compare to his automated financial system—built 15 years ago and still running every day with minimal oversight.

You can do the same by connecting your checking account to all your financial destinations: savings, investments, bills, and spending. Once the money hits your checking account (e.g., on payday), it should be divided and transferred to the right places without your intervention.

He provides a sample breakdown based on the Conscious Spending Plan from Chapter 4:

- 50–60% for fixed costs like rent and bills

- 10% for long-term investments like 401(k) or Roth IRA

- 5–10% for savings goals such as vacations or emergency funds

- 20–35% for guilt-free spending on things like dining or entertainment

2. Use Defaults and Psychology to Your Advantage

Sethi emphasizes the behavioral science behind automation. Defaults work because we are lazy by nature. Once a system is set, most people will stick to it simply because changing it takes effort. He jokes that the system should be so robust that even if you were eaten by a Komodo dragon, it would keep transferring money on your behalf.

This system helps overcome the psychological resistance that keeps most people from saving. While others constantly say they “should save more,” you’ll actually be doing it—without even thinking about it.

3. Apply the Next $100 Principle

To reinforce the automation mindset, Sethi introduces the “Next $100” concept. Every time you earn more money—say a bonus, tax refund, or raise—you should already know how it will be allocated based on your plan. For example, if your spending structure is 60% fixed costs, 10% investments, 10% savings, and 20% guilt-free, then every $100 should be split accordingly.

This principle forces you to be intentional with new money, which is where many people fail by letting extra income simply get absorbed into mindless spending.

4. Addressing Irregular Incomes

For freelancers or entrepreneurs with inconsistent earnings, Sethi offers solutions too. The key is to determine an average monthly income based on past data and automate around that. When income is higher, save the extra. When lower, dip into previously saved buffer funds. Automation works even when income is unpredictable—it just requires a bit more setup.

5. Real-Life Examples of Automation Success

Sethi includes testimonials from readers who transformed their finances through automation. One reader, Jenna Christensen, noted that after setting up her system, she only needed to think about money a few times a year. Another reader, Alissa McQuestion, used automated savings to pay off debt, fund a wedding, and buy a home in San Diego that appreciated from $250,000 to $700,000.

He presents the automation process as a way to shift from constantly budgeting to living freely, knowing your money is doing its job.

6. Action Steps for Week Five

Sethi’s Week Five tasks walk readers through creating their own automated system:

- Set up automatic bill pay for rent, credit cards, and utilities from your checking account. This ensures you never miss payments and improves your credit.

- Schedule automatic transfers to your savings account right after payday. Treat savings like a recurring bill so it’s prioritized.

- Automate investments such as 401(k) contributions through your employer and Roth IRA transfers through your brokerage account.

- Link accounts properly. Connect your checking account to savings, credit cards, and investments so the transfers happen seamlessly.

- Apply the “Next $100” rule. Every time new income arrives, allocate it automatically based on your spending plan percentages.

7. Feed the Machine

Sethi stresses that automation only works if there’s money to feed it. Now that the system is in place, your focus should shift toward increasing the amount you contribute. He likens it to a magical money machine that turns every $1 into $5—your goal is to feed it as much as you can.

He provides a growth chart showing how even $100/month can grow to over $95,000 in 25 years, while $500/month turns into nearly half a million. These numbers show the power of compound returns and make a strong case for funding your system as aggressively as possible.

The Best Financial Decision You’ll Ever Make

Automating your finances isn’t just a convenience—it’s a transformative decision. It eliminates decision fatigue, emotional friction, and procrastination. With this system, saving and investing become default behaviors rather than burdensome tasks.

By doing the work once and letting the system run, you position yourself to build wealth passively, consistently, and confidently. As Sethi puts it, “Do the work now and benefit forever—automatically.”

8. The Myth of Financial Expertise

In Chapter 6 of I Will Teach You to Be Rich, Ramit Sethi takes direct aim at the perceived wisdom of financial experts. He argues convincingly that most financial “professionals” are no better than amateurs—and sometimes worse. With a combination of research, examples, and irreverent humor, Sethi debunks the illusion of financial expertise and urges readers to take control of their own investing.

1. Experts Aren’t Always What They Seem

Sethi opens the chapter with a story from the wine industry. In a study conducted by a researcher at the University of Bordeaux, 57 wine experts failed to realize they were tasting two glasses of the exact same white wine—one of which had simply been dyed red. The takeaway? Even trained experts can be fooled, and the same applies to financial advisors.

He explains that American culture tends to revere experts, from doctors and lawyers to financial pundits. However, expertise should be measured by results—not credentials. In personal finance, the results speak for themselves: poor savings rates, low investment participation, and widespread debt. Clearly, the expert-driven model isn’t working.

2. Investment Experts Can’t Predict the Market

Sethi explains that most fund managers and TV pundits rely on market forecasting—what’s known as “timing the market.” But the truth is, no one can consistently predict the stock market’s movements. People send him questions every day about sectors like energy or Google stock, but his answer is always the same: he doesn’t know—and neither do the so-called experts.

He compares these predictions to weather forecasts made by butterflies flapping their wings in China: dramatic, but meaningless. And unlike weather forecasters, financial pundits aren’t held accountable when they’re wrong. They simply keep making new predictions with confidence.

3. Financial Advisers Often Cost You More Than They Earn You

Sethi pulls no punches when discussing financial advisers. He shares how many are incentivized by commissions, not your best interests. They may recommend bloated mutual funds because they earn kickbacks, not because the funds are good for you. In one reader example, a man lost 30% of his money investing through a financial adviser recommended by his bank. He eventually moved his money to Vanguard index funds and never looked back.

Most young people, according to Sethi, don’t need a financial adviser. Their financial situations are simple enough to manage with a basic understanding of personal finance and a few hours of setup. Paying someone tens of thousands of dollars over time just to avoid learning about investing is a costly mistake.

4. The Illusion of Stock-Picking Skill

To explain how even poor advisers can appear skilled, Sethi uses an example of a fake stock-picking scheme. A scammer sends predictions to 10,000 people, telling half that Stock A will go up and the other half that Stock B will go up. After one rises, he only continues with the “correct” group, splitting it again and again. Eventually, a few hundred people believe he’s correctly predicted multiple outcomes—even though it was all random. This is how people get fooled by past performance and flashy stats.

Sethi also reveals the practice of survivorship bias—how funds with poor performance are quietly removed from reports, leaving only the winners visible. This distorts the track record and makes it seem like the experts consistently win, when in fact most actively managed funds fail to beat the market.

5. Don’t Let Invisible Scripts Hold You Back

A key part of this chapter involves addressing the “invisible scripts” that keep people relying on advisers. Sethi lists several common ones:

- “I don’t know, I just want someone else to handle it.” He responds by encouraging readers to build their own skills instead. Learning how to invest is far more profitable than outsourcing it blindly.

- “I like my adviser. He’s trustworthy.” Sethi warns that likability doesn’t equal effectiveness. He shares a study showing that people often judge doctors by bedside manner, not actual results. Trust your system, not your adviser’s charm.

- “I’m afraid of losing money.” He reassures readers that high adviser fees guarantee losses. Every dollar spent on unnecessary fees is money that could have been growing.

6. You’re in Control of Your Wealth

Sethi makes it clear that wealth is not about genius stock picks—it’s about consistent saving and long-term investing in low-cost funds. He argues that recognizing you’re in control of your financial life is both empowering and challenging. If you fail, you can’t blame the market or your adviser. But if you succeed, the credit is yours too.

He even shares a personal anecdote about two wealth managers who tried to recruit him—despite the fact that he literally wrote a bestselling book on personal finance. He sat through the meeting pretending to know nothing, just to observe their pitch. Unsurprisingly, they focused on vague “value adds” rather than actual performance.

7. When Should You Use a Financial Adviser?

Sethi isn’t entirely against advisers—he just wants you to use them wisely. If you have seven-figure assets or complex needs involving estate planning or taxes, he suggests hiring a fee-only adviser for a few hours of targeted support. Otherwise, the tools in this book—and a disciplined system—are more than enough.

Expertise Is Overrated—Discipline Wins

Chapter 6 is a powerful rejection of the myth that only “experts” can manage your money. With plenty of humor, logic, and hard data, Sethi shows that anyone can outperform the pros by avoiding high fees, ignoring market hype, and investing in simple, low-cost funds.

The chapter doesn’t contain action steps—but it sets the stage for the next one, where you’ll finally choose your investment portfolio. Until then, the key takeaway is this: don’t pay for illusion. Build skill, stay consistent, and trust the plan.

9. Investing Isn’t Only for Rich People

In Chapter 7 of I Will Teach You to Be Rich, Ramit Sethi shatters the illusion that investing is a complex, high-risk game reserved for the wealthy. He provides a comprehensive and accessible guide to selecting a simple investment portfolio that works for everyday people. The chapter emphasizes simplicity, automation, and cost-effectiveness, all while ensuring your investments align with your goals and risk tolerance.

1. Determine Your Investment Style Through Key Questions

Before choosing any funds, Sethi prompts readers to understand their financial situation and temperament by asking crucial questions:

- Do you need this money within the next year?

- Are you saving for a specific goal, like buying a home?

- Can you emotionally handle fluctuations in the stock market?

These questions help define how aggressive or conservative your investment choices should be. For example, someone saving for a house in the next three years should not risk investing in stocks, while someone investing for retirement in 30 years should take full advantage of long-term growth opportunities.

2. Embrace the Simplicity of Automatic Investing

Sethi openly admits that he doesn’t love managing money and prefers to automate as much as possible. Automatic investing lets you “set it and forget it,” freeing up time for more enjoyable pursuits. He recommends that readers aim for automation paired with low-cost investments—getting better results with less effort.

3. Choose Your Investment Approach

You can either build your own portfolio or choose a simplified route. Sethi lays out two main approaches:

- Target Date Funds – These are ideal for those who want a hands-off experience. You simply pick a fund with a date close to your retirement (e.g., 2060), and the fund automatically adjusts its asset allocation over time, shifting from aggressive to conservative.

- Hand-Picked Portfolios – For those who want more control, you can build your own asset allocation. Sethi recommends starting with a few low-cost index funds (e.g., total stock market, international stock market, and bonds) and adjusting the proportion based on your risk tolerance.

He explains how to use asset allocation percentages to direct your investments. If you invest $1,000/month and your allocation says 30% should go to domestic stocks, then $300 goes to that fund. You repeat this for each category to maintain balance.

4. Understand the Importance of Asset Allocation

Asset allocation—the mix of investments across stocks, bonds, and other categories—is more important than trying to pick the “best” stock. Sethi cites David Swensen’s model as an example and shows how the right allocation can dramatically affect your returns while controlling risk.

He warns against splitting investments evenly across all your funds, as many beginners do. Instead, calculate the dollar amount for each fund based on its percentage in your chosen allocation model.

5. Avoid Overcomplication and Financial Noise

The chapter also serves as a reminder that investing doesn’t need to be complicated. Sethi encourages readers to ignore financial media hype, avoid daily checking of accounts, and stop trying to “beat the market.” Consistency and simplicity outperform drama and speculation in the long run.

He includes examples of young investors like Smit Shah, who used Sethi’s approach to build over $300,000 in savings across investment accounts by age 30.

6. Watch Out for “Advanced” Distractions

Sethi discusses distractions like cryptocurrency and precious metals, which attract attention but rarely deliver results. While it’s okay to put a small percentage of your portfolio into fun bets or stocks you love, these should never be the foundation of your financial future. He also critiques real estate as an “investment” for most people, pointing out that personal residences typically don’t generate strong returns when you factor in all costs.

7. Choose Between Control and Convenience

You can pick between doing it yourself or using a robo-advisor like Wealthfront or Betterment. While some providers (like Vanguard) offer more control, robo-advisors offer more convenience. Sethi reminds readers that the most important decision has already been made: choosing to invest in low-cost, long-term funds. The platform you pick is less critical—just make the choice and move forward.

8. Action Steps for Week Six

To put this all into action, Sethi offers practical steps:

- Decide your investment style. Are you more hands-on or do you prefer to delegate? Based on this, choose between a target date fund or building your own portfolio.

- Select your asset allocation. If building your own portfolio, decide what percentage goes to domestic stocks, international stocks, and bonds. Use research and personal risk tolerance to guide you.

- Choose your investment provider. Whether it’s Vanguard, Schwab, Fidelity, or a robo-advisor, go with a platform offering low fees and easy automation.

- Invest consistently. Use automation to contribute a fixed amount every month. Even if it’s just $50/month, start now and increase as your income grows.

- Ignore the noise. Don’t get distracted by market swings or headlines. Stick to your plan and stay the course.

Investing Is the Real Game Changer

Chapter 7 is the moment when everything comes together. It’s not about stock picking, trend chasing, or becoming a finance expert. It’s about building a simple, reliable, automated investment system that works for the long term.

The message is clear: You don’t need to be rich to start investing, but you must start investing to get rich. By following this chapter’s plan, you move from financial confusion to clarity and confidence—earning while you sleep and building a Rich Life on your own terms.

10. How to Maintain and Grow Your System

In Chapter 8 of I Will Teach You to Be Rich, Ramit Sethi provides readers with a strategy for sustaining and strengthening the financial systems they’ve already built. This chapter is not about starting over; it’s about advancing what you’ve created by feeding your system, ignoring distractions, staying realistic, and staying aligned with your personal vision of a Rich Life. It’s the “extra credit” for those who want to level up and keep their momentum going.

1. Reflect on Why You Want More

Sethi begins by encouraging readers to examine their motivations. It’s not enough to blindly pursue more money. You have to ask: what’s the point? Is your goal to retire early, live luxuriously, travel freely, or simply reduce financial stress?

He warns against falling into the trap of “living in the spreadsheet”—constantly optimizing and calculating without enjoying the rewards. Instead, he advocates for conscious ambition. If you want to splurge on VIP concert tickets or coach high school lacrosse while holding a full-time job, your system should support that dream. You’ve already won the first level by setting up your financial infrastructure—now you must decide if, and why, you want to keep building.

2. Feed Your System: More In, More Out

Sethi reinforces that the effectiveness of your system depends on what you put into it. The automatic setup from previous chapters works, but to grow wealth meaningfully, you must increase contributions. Whether your goal is FIRE (Financial Independence, Retire Early) or a lifestyle of urban luxury, the next step is to put more money into your system every month.

This might mean saving an extra $100 or $200 each month. Thanks to compounding, these small increases can dramatically improve your financial future. Using an 8% return benchmark, investing $500/month for 10 years can grow to over $95,000.

To do this effectively:

- Revisit your spending plan.

- Adjust categories to free up more for investments.

- Look for income increases—raises, side gigs, or negotiating a better salary.

As one reader shared, this method helped him pay off debt, fund a wedding, and buy a home that appreciated significantly in value.

3. Rebalance Your Portfolio

One of the trickiest parts of managing your own investments is rebalancing. Sethi explains that over time, the different parts of your portfolio will grow at different rates, skewing your original asset allocation. For example, stocks may grow faster than bonds, which means your portfolio could become riskier than intended.

Rebalancing involves checking your portfolio once or twice a year and adjusting the amounts to match your original plan. If one fund has grown too large, you sell some of it and use the money to buy more of another category. This is one of the few times Sethi encourages you to sell—but with intention, not emotion.

4. Ignore the Financial Noise

The media and social media are filled with constant chatter about the stock market, Bitcoin, real estate, and economic panic. Sethi urges readers to tune this out. Long-term investors should not make changes based on the news cycle. If your investments are chosen correctly and automated, your best strategy is to stay the course.

He reminds readers that good investing is boring, and that’s what makes it effective. Let other people chase the hot tips—you stick to your plan.

5. Update Your Conscious Spending Plan Annually

Sethi recommends conducting an annual review of your system. In December, spend a few hours reviewing your financial picture. Ask:

- Are your savings and investment percentages still accurate?

- Are you paying for subscriptions you don’t use?

- Are your goals still the same?

This yearly check-in helps keep your plan aligned with your evolving life. If your income has grown, reallocate funds to increase savings or investment. If expenses have changed, adjust accordingly. Most importantly, make sure the plan is still realistic enough for you to stick with long-term.

6. Give Back: The Ultimate Return

Sethi closes the chapter by discussing the importance of philanthropy. Whether it’s time or money, giving back is one of the most fulfilling parts of living a Rich Life. He personally volunteers through New York Cares and donates to educational charities like Pencils of Promise.

Philanthropy may not increase your net worth, but it enhances your life’s richness. He considers it one of the best “returns” he’s ever gotten.

7. Stay Human: Life Is More Than the Numbers

Perhaps the most important message in this chapter is to avoid becoming obsessed. Sethi cautions readers not to become the person constantly chasing the next percentage point or tweaking allocations weekly. Your Rich Life is about freedom, meaning, and joy—not perfect spreadsheets.

He reminds readers that money is a tool. Once your system is automated, let it run in the background. Use the time and freedom it creates to live the life you designed—travel, spend guilt-free on your passions, and enjoy the peace that comes from knowing your finances are handled.

You’ve Built the Machine—Now Fuel It

Chapter 8 marks the transition from setup to mastery. You’ve built a powerful system that runs on automation and clear priorities. Now, your job is to fuel it with contributions, adjust it as life changes, and avoid distractions.

With intention, discipline, and purpose, your Rich Life becomes not just a goal, but a sustainable way of living.